Overview

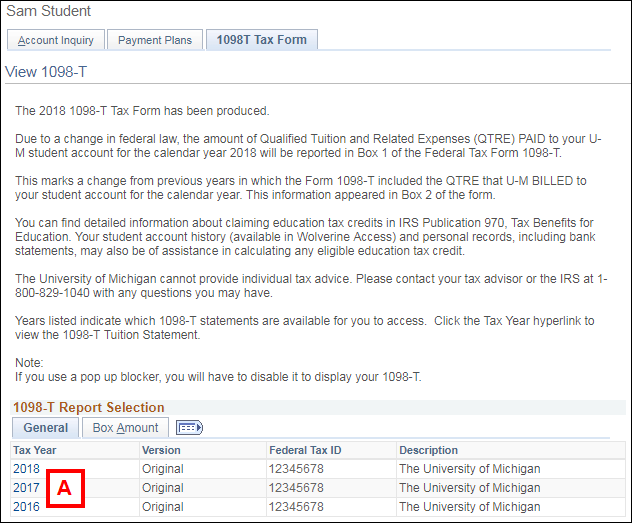

The View 1098-T page displays a list of the 1098-T statements for each tax year where a 1098-T form has been created.

The University of Michigan cannot provide individual tax advice and shall not be liable for damages of any kind in connection with this information. Please contact your tax advisor or the IRS at 1-800-829-1040 with any questions you may have.

Field Descriptions and Examples

1. View 1098-T - Select Tax Year

| Letter | Field | Description |

|---|---|---|

| A | Tax Year | Clicking the tax year opens the specific data for that 1098-T. |

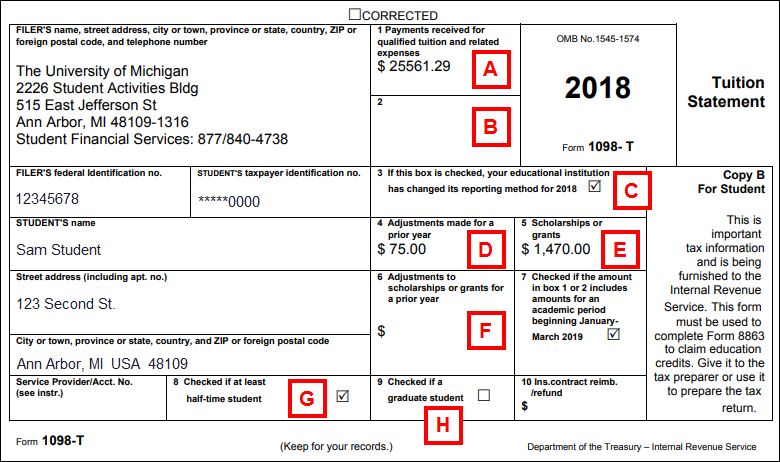

2. Form 1098-T - PDF Document Page 1

| Letter | Field | Description |

|---|---|---|

| A | Box 1 | For tax years 2018 and later, payments received include scholarships, grants, loans, payment plans, and personal payments for the tax year. Note: Payments received does not include graduate student tuition waivers. |

| B | Box 2 | For tax years 2017 and earlier, amounts billed include tuition, registration fees and any class fees for the tax year. |

| C | Box 3 | Beginning with the tax year 2018, the university is required to report Payments Received (Box 1) rather than Amounts Billed (Box 2) for any student receiving a 1098-T. This box is checked for all 2018 1098-Ts. |

| D | Box 4 | Includes adjustments to tuition, registration fees, and any class fees for a prior tax year that posted in the tax year on the form. |

| E | Box 5 | Includes scholarships and grants that disbursed during the tax year, including adjustment disbursements for terms in a prior tax year. |

| F | Box 6 | Includes reversals of scholarships and grants that disbursed in the prior tax year but have been reversed in the tax year on the form. Only the reversal portion of a scholarship or grant adjustment is included in box 6. If a new amount was disbursed for a prior tax year, it is included in box 5. |

| G | Box 8 | This box is checked if the student was at least a half-time student during any academic period that began during the tax year. |

| H | Box 9 | This box is checked if the student was a graduate student during any academic period that began during the tax year. |

3. Form 1098-T - IRS Instructions - PDF Document Page 2

The second page contains the IRS instructions for the 1098-T.

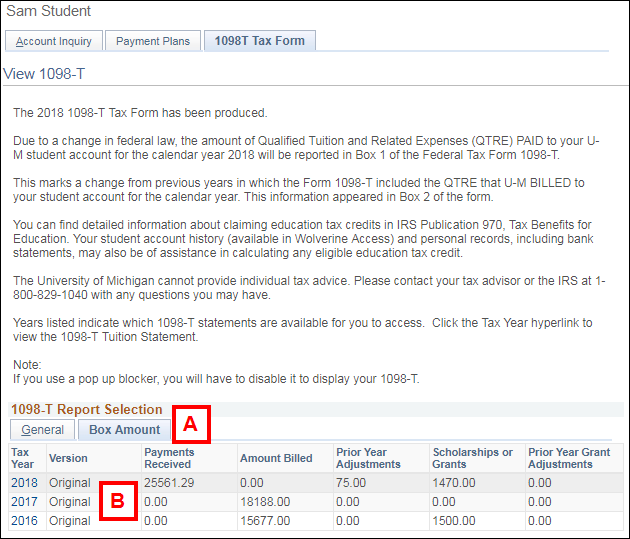

4. View Box Amount Details

| Letter | Field | Description |

|---|---|---|

| A | Box Amount | Clicking the Box Amount tab provides access to additional information for the tax year. |

| B | Payments Received | Depending on the aid year selected, details may be available for Payments Received, Amounts Billed, Prior Year Adjustments, Scholarships or Grants received, and/or Prior Year Grant Adjustments. This detail corresponds to your student activity for the terms reported. |

Related Help Topics

Contact Information

Visit the Student Financial Services website at www.finops.umich.edu/student or email um-sfo@umich.edu.

Telephone: (734) 764-7447

Toll Free: (877) 840-4738 (From within the U.S. and Canada ONLY)

Campus address:

Student Financial Services

2226 Student Activities Building

515 E. Jefferson

Ann Arbor, MI 48109-1316